This guide describes the basic tax functionality feature. This feature allows the marketplace to charge VAT tax to the freelancers on the commission that they take and for freelancers to charge VAT tax on the services they provide. There is also an Advanced tax feature that provides the option of setting custom tax rates for each user/contract.

Video Guide

Step by Step Guide

This feature is activated in the “Settings” menu item of the admin dashboard by selecting ‘Enable basic tax functionality? (Optional)’.

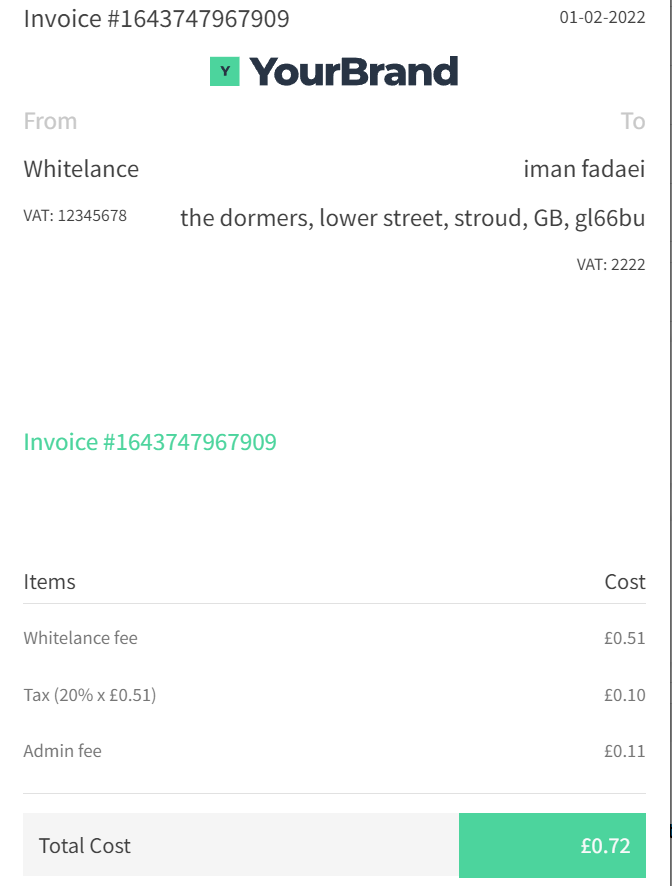

This creates an input window where the admin can input the VAT rate they will include to the commission fees they charge their sellers. In the image above, the VAT charge from the marketplace to freelancers is 20%. This will automatically be included in all invoices that are issued from the marketplace to the freelancer.

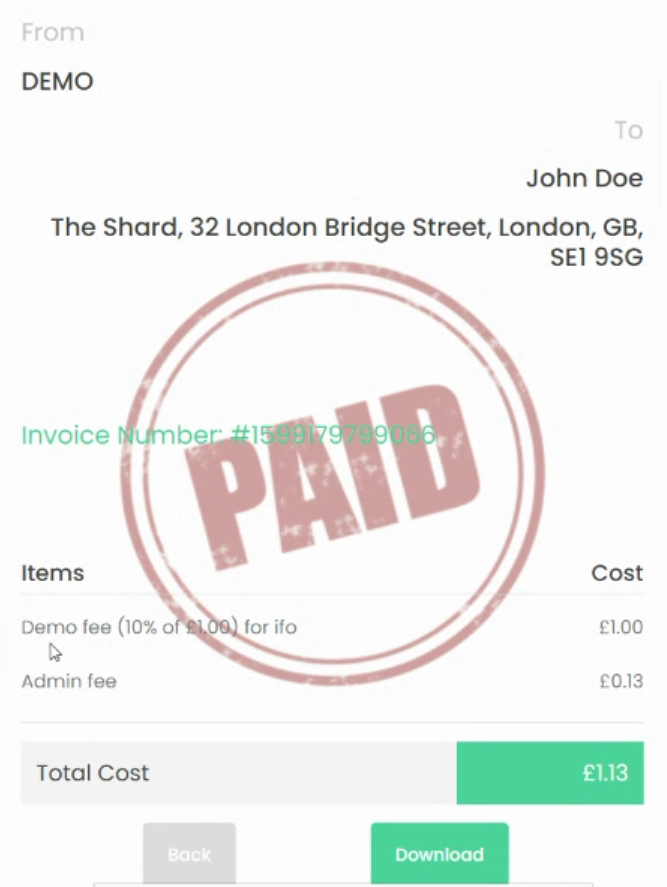

When this feature is not activated, the commission invoice would appear similar to the image below. The Admin fee refers to the Stripe transaction fee.

When this feature is enabled, the commission invoice includes the tax, as shown in the example image below.

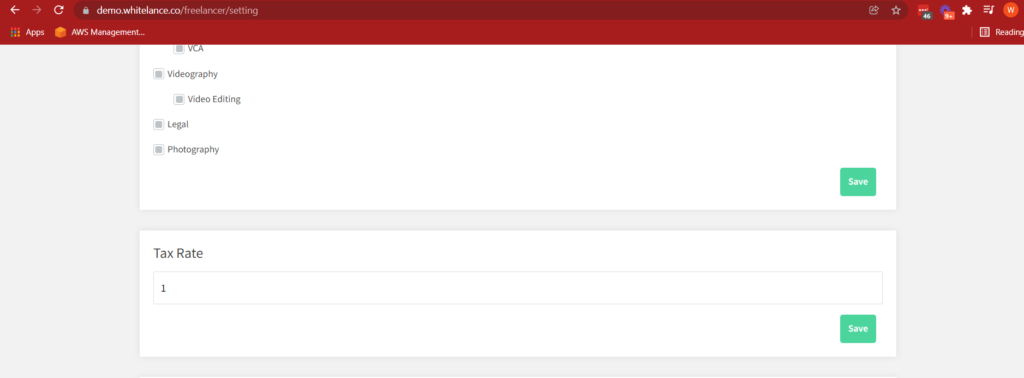

When this feature is enabled, it also creates a block on the Freelancer’s ‘Settings’ page titled ‘Tax Rate’. Here, the freelancer can set the VAT tax rate that they will charge their clients.

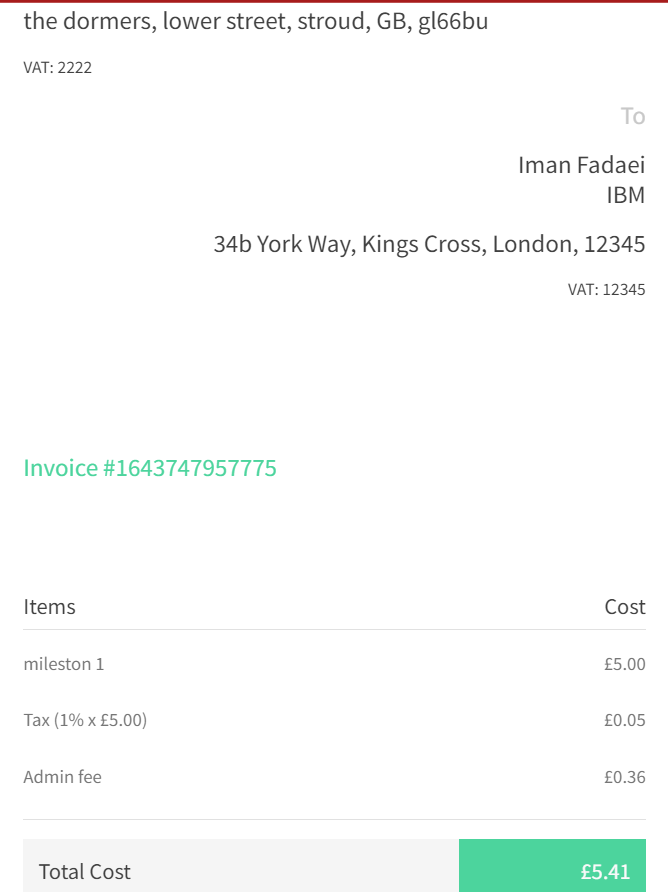

This rate can be changed at any time and once it has been changed the milestones that are subsequently ‘approved’ (funds are released from escrow to the the freelancer), will show the new VAT rate. Below is an image showing the invoice for a milestone valued at £5, where the FL has set a 1% VAT charge on their settings page. This invoice is automatically generated once the milestone has been approved.