This guide describes the advanced tax feature, which allows the administrators to set a custom tax rate for each user, and for each freelancer to set a custom tax rate for their customers. This is a useful feature if your talent pool is registered in different countries with varying tax rates.

Advanced Tax Feature Video Guide

Step by Step Guide

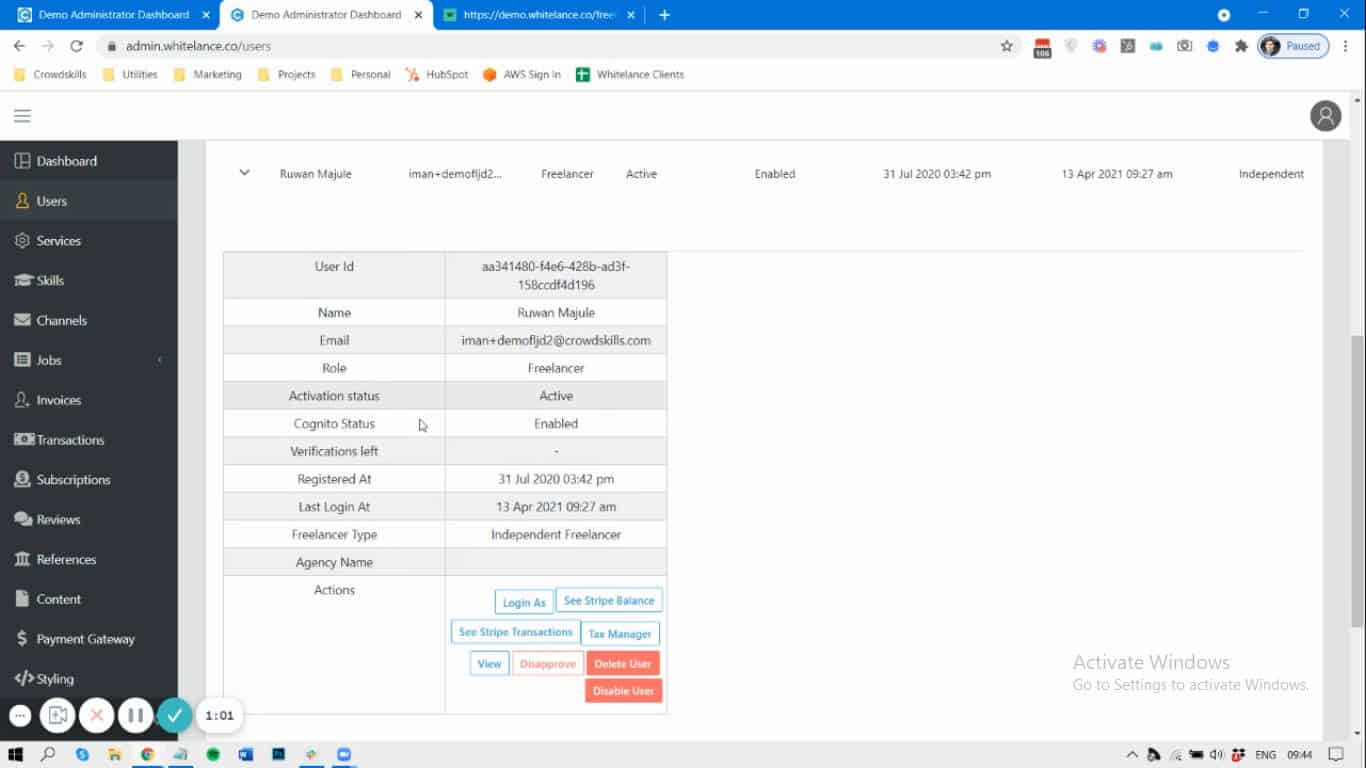

This feature is activated in the “Platform Settings” menu item of the admin dashboard. Once it has been activated a generic tax rate can be set for all users, which will affect the amount the marketplace charges its users for providing their service, whether through subscriptions or commissions. If some users require a different tax rate, this can be set manually by the admin by going to the “Users” menu item, selecting the user and opening the “Tax Manager” option.

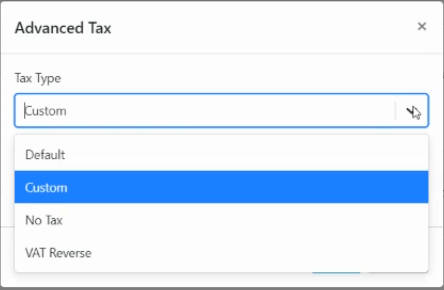

In the Tax Manager, four options exist, which is to use the default tax rate, create a custom tax rate, set a 0% tax rate, or have a reverse VAT charge (used in European countries).

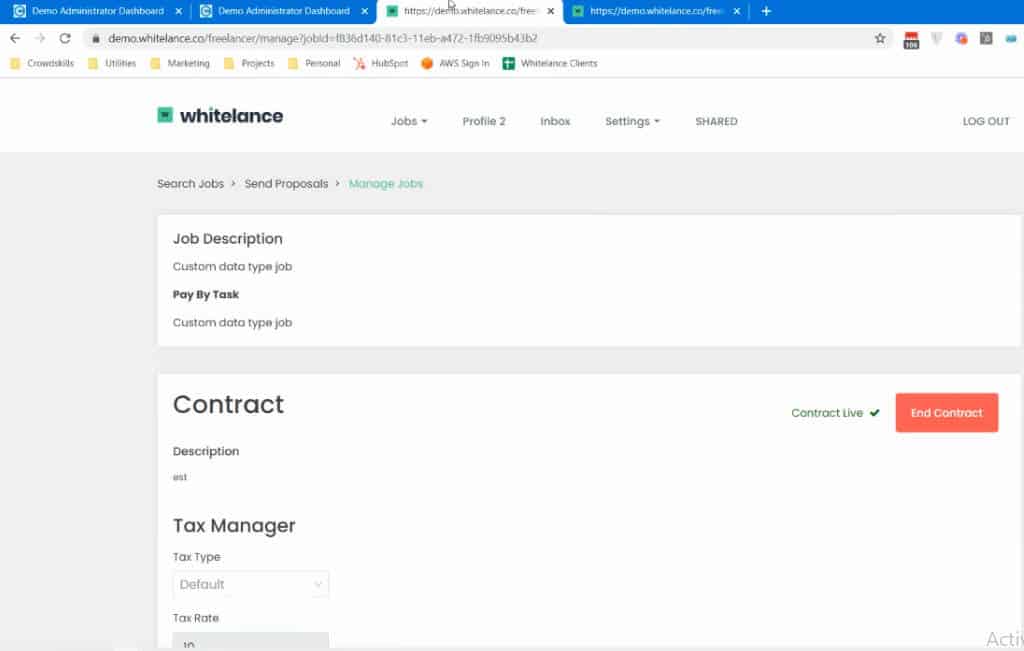

The Advanced Tax option also creates the option for a freelancer to alter the tax rate for each contract depending on the job they are doing. By going to their current jobs, they are given the same tax manager options as shown above.

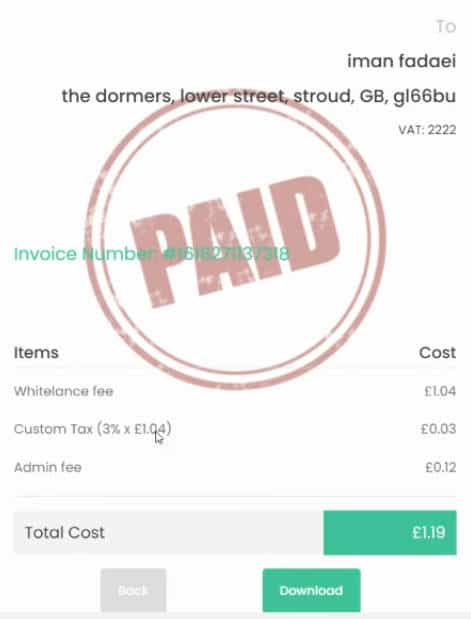

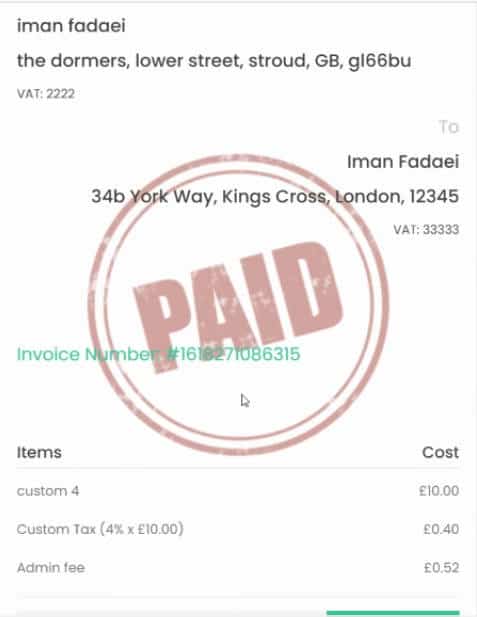

The effects of both of these two options are shown in the images of the invoices below. One is between the marketplace and the freelancer, while the other is between the freelancer and the customer.